The S&P 500 Index entered its first technical correction in over a year (a drop of at least 10%) last week as Russian tanks rolled into Ukraine. This was just the latest in a series of hits to potential economic growth and stock valuations in early 2022. As noted in our last Bulletin, stock valuations were already under pressure from the dual threats of tighter fiscal and monetary policies designed to curtail inflationary pressures.

The index reached an intraday low on Thursday, February 24th, of 4114. That price represented a 14% drop from the all-time index closing high of 4796 on January 3rd, 2022. The closing price on Thursday was closer to a 12% drop and by yesterday, prices were hovering around the 10% correction level. The question on most investor’s minds is what comes next?

We remind our clients that a 10% to 15% correction is not out of the norm in any given year. In fact, this correction was overdue in our opinion as we noted in our last two write-ups. We had taken some risk off the table at the start of the fourth quarter as valuations were stretched in some sectors of the market.

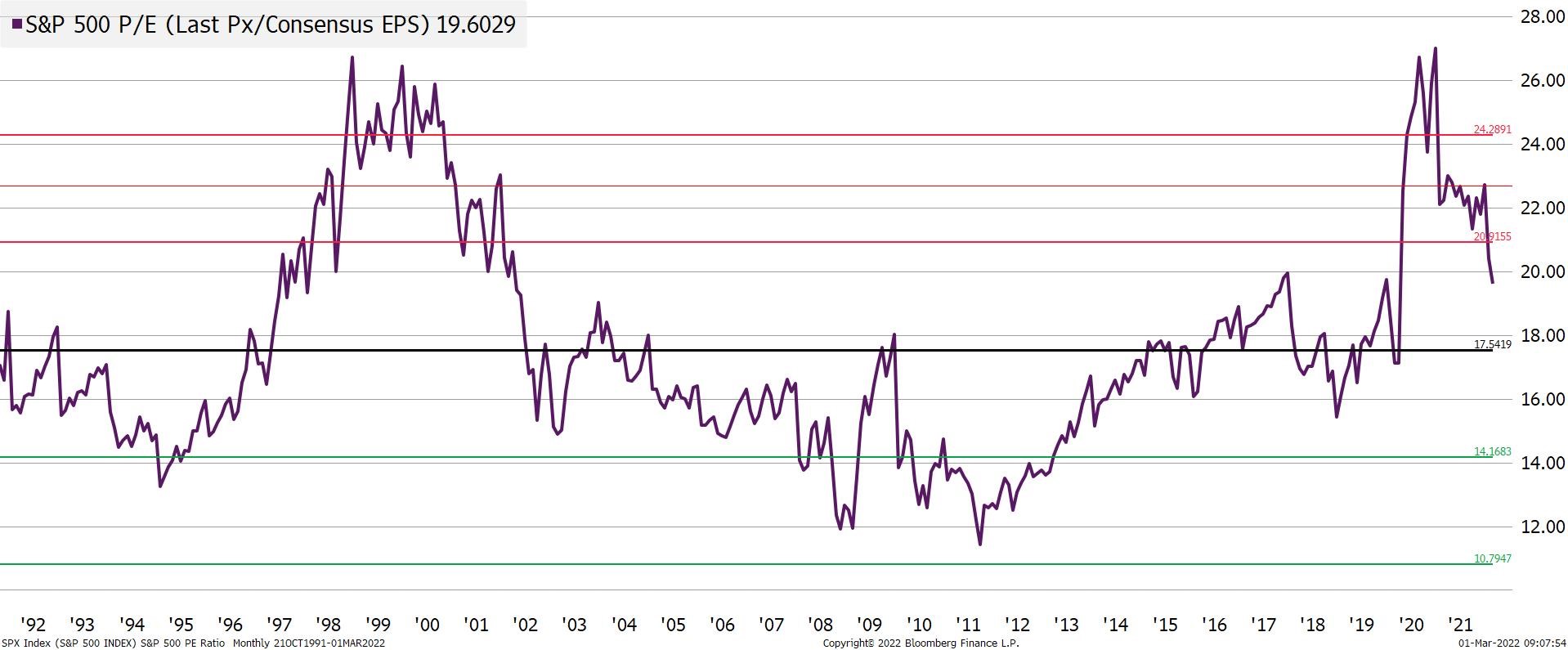

Valuations have now improved as shown on the price to earnings chart below. The forward PE ratio is now within one standard deviation of the longer-term average price. While economic growth is expected to slow considerably in 2022, the risk of recession is still low. The labor market remains tight, and consumer balance sheets are still conducive to spending. While corporate earnings growth is likely to slow, we don’t foresee a meaningful drop in earnings this year.

As such, we see this pullback as an opportunity to deploy some cash for our investors with “new” money or large amounts of cash on the sideline. However, we caution against getting too aggressive just yet. Despite the bounce from Thursday and Friday, the triple threat to growth and valuations described above may not be fully priced in. Given the magnitude of the run up in stocks from the March 2020 low to the recent high, the market may still have a little more to give back. The index remains in a short-term downward channel as shown above and we do expect the market to remain choppy throughout the first half of 2022 especially if geopolitical events worsen.

Should the S&P 500 Index breach the 4114 price point, we would look for the next technical support level to be around 3800. This level corresponds to the next Fibonacci support line and matches up to a March 2021 pullback with elevated volume (check out Fibonacci sequence on YouTube if you are really bored one day). Should markets reach 3800 we would view this as an opportunity to get a little more aggressive. That level would mark a 20% pullback and history has shown that buying on 20% pullbacks usually works out well for investors. It would also pull stock valuations (as measured by forward PE ratio) below the long-term average marking a better point to be more aggressive.

As always, please reach out to your LCNB portfolio manager or advisor if you have additional questions.