Supply and demand imbalances are showing up in almost all sectors of the economy including housing, autos, lumber, and of course labor to name a few. The mechanism for restoring order to these imbalances is almost always price. Too much housing supply and the price falls causing builders to exit the market. Not enough labor supply and wages rise encouraging people to look for work.

It is no surprise that the topic on most market participants minds (including my own) is inflation or in other words the future price of goods and services. Inflation, as stated by Milton Friedman, “is caused by too much money chasing after too few goods”. The prospects of inflation will be top of mind for Fed Chair Jerome Powell and his colleagues as they meet next month in Jackson Hole for their annual retreat to review interest rate policy. The Fed will be drilling down into the data to decipher which of these inflationary pressures is transitory, or temporary, versus those likely to persist.

Examining the price action of lumber over the past 12 months, we see some clear evidence of transitory inflation with the potential for some lesser amount of permanent increase. The supply chain was cut off by a shutdown in international trade while at the same time consumers were flush with stimulus cash. Adding to this inflation recipe was a consumer that could not travel, go to the movies, or out to eat. The result in the spring of 2020, was a spike in trips to Lowe’s and Home Depot for projects around the house. Supply dropped dramatically while demand increased at the same time leading to a massive increase in lumber prices. As we move into the second half of 2021, borders are re-opening, consumers are spending money on other goods and services, and sky-high lumber prices are starting to retreat. The amount of the price increase in lumber that will stick around is yet to be determined.

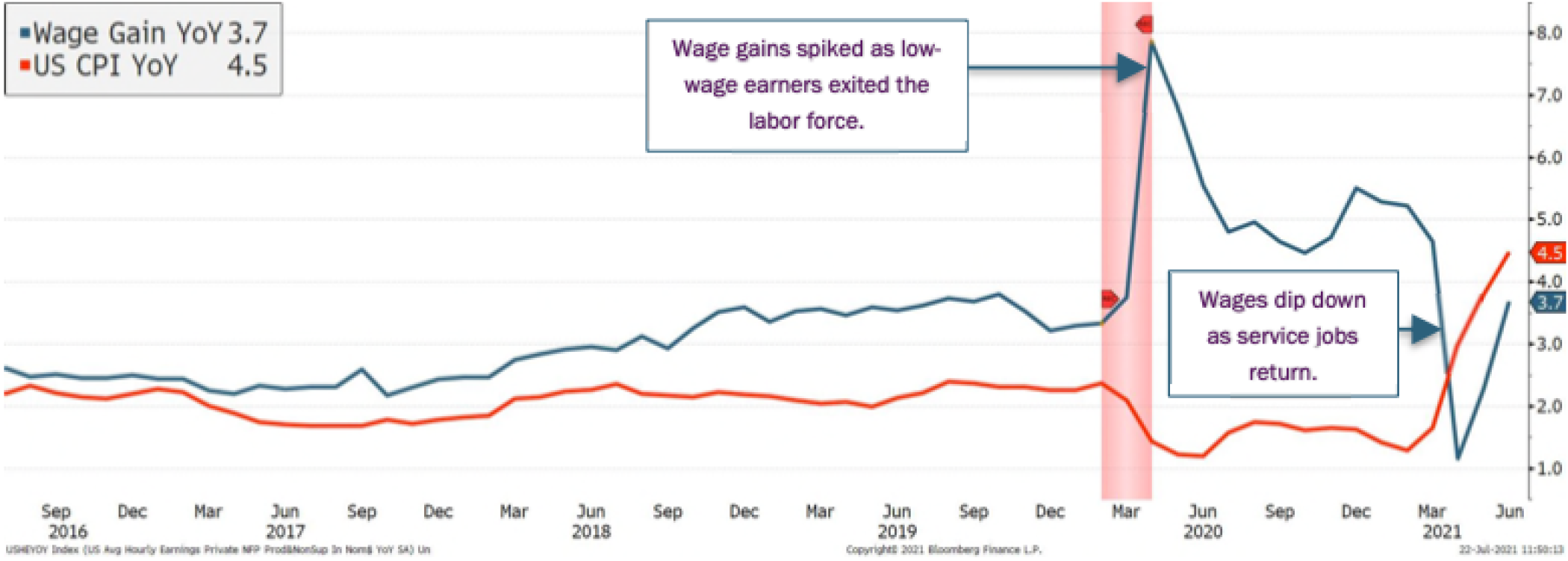

The Fed will no doubt be looking at price data for all sorts of goods and services, but none more so than labor and wages. Historically, wage data has been the most reliable precursor to broad and persistent inflationary pressures. The July wage data has returned to pre-covid levels following artificial spikes and contractions based on service jobs exiting and then reentering the labor force. It will likely take several more months of employment data before we have a good feel for the true level of wage gains in the economy.

For the time being, the Fed remains very accommodative with near zero short-term interest rates and $120 billion worth of monthly bond purchases to suppress longer-term rates. The August meeting may present an opportunity to signal a slow-down in bond purchases during the second half of the year if the labor market continues to recover as expected. However, do not expect any change in the short-term Fed Funds rate until well into 2022. The Fed has already stated that they are willing to let inflation run ahead of their 2% target for some time. Recent moves in the stock and bond markets suggest little concern for inflation in the near-term.