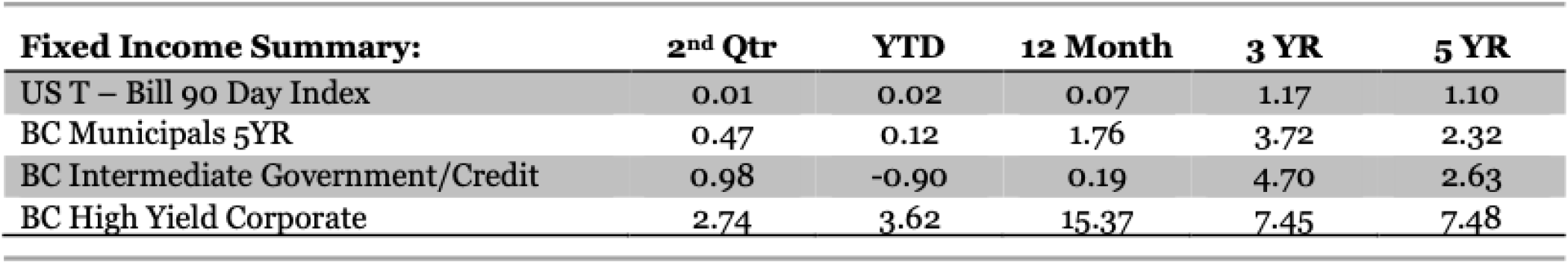

In the first quarter, inflationary concerns caused rates to trend higher. Once some of these inflationary concerns came to fruition during the second quarter, interest rates did an about-face and moved lower. The increase in the beginning of the year happened so quickly that when we actually saw the YoY CPI above 4%, long term rates actually contracted. This yield contraction erased half of the loss in the bond market: the Bloomberg Barclays Government Credit Index went from a 1.86% loss in the first quarter to being down only 0.90% YTD.

The 10-year Treasury moved lower 28 basis points (bps) to end the second quarter at 1.46%. The 2-year Treasury, contrarily, increased by 8 bps from 0.16% to 0.24%. The yield curve flattened during the quarter, with the spread between the 2- and 10-year Treasury closing at 1.21% compared with 1.58% at the end of the first quarter. The Federal Reserve (Fed) has kept interest rates low on the short end keeping the Fed Funds rate at 0%-25% since March of 2020. The Fed’s commitment to purchasing bonds continues and the spread between high yield bonds and treasury bonds lowered to 2.68% - this is a change of 36 bps from the end of the first quarter.

The recent trends in yields can be attributed to strong demand in the bond market. If investors view the stock market as fully valued and the current interest rates as an attractive alternative, portfolio rebalancing from equities into fixed income will continue. Additionally, there is still a lot of cash on the sidelines. These two potential sources of funds (from the equity rebalancing and sidelined cash) could push rates even lower in the short term. We continue to favor high quality, shorter duration fixed income securities for portfolios.