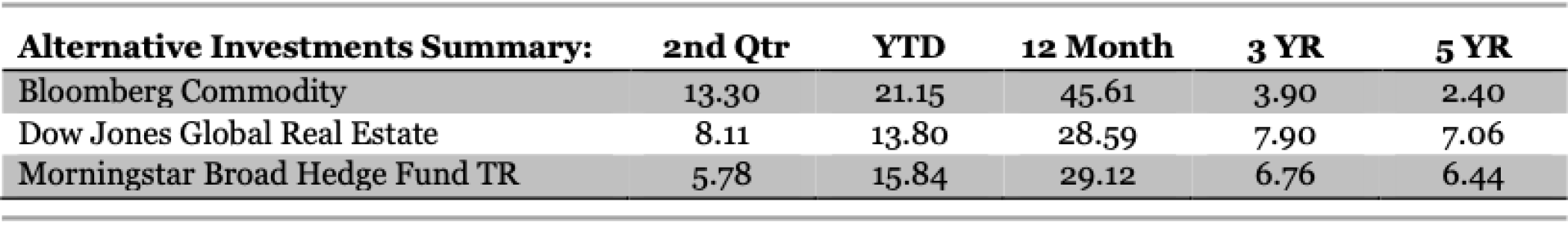

Oil continued to rally in the second quarter of 2020, ending up over 24%. This led the commodity index to outperform versus other asset classes, returning 13.3% for the quarter. As the reopening of the economy continues, we will continue to monitor commodities as a whole and gold as a potential inflation hedge for our portfolios. We still believe valuations of stocks and bonds are stretched and maintain an overweight recommendation to alternatives. The goal of our alternative allocation is to enhance the risk adjusted return of our portfolios. For a long time, alts were a drag on our portfolio performance, but we have seen added value in the last 6 months.