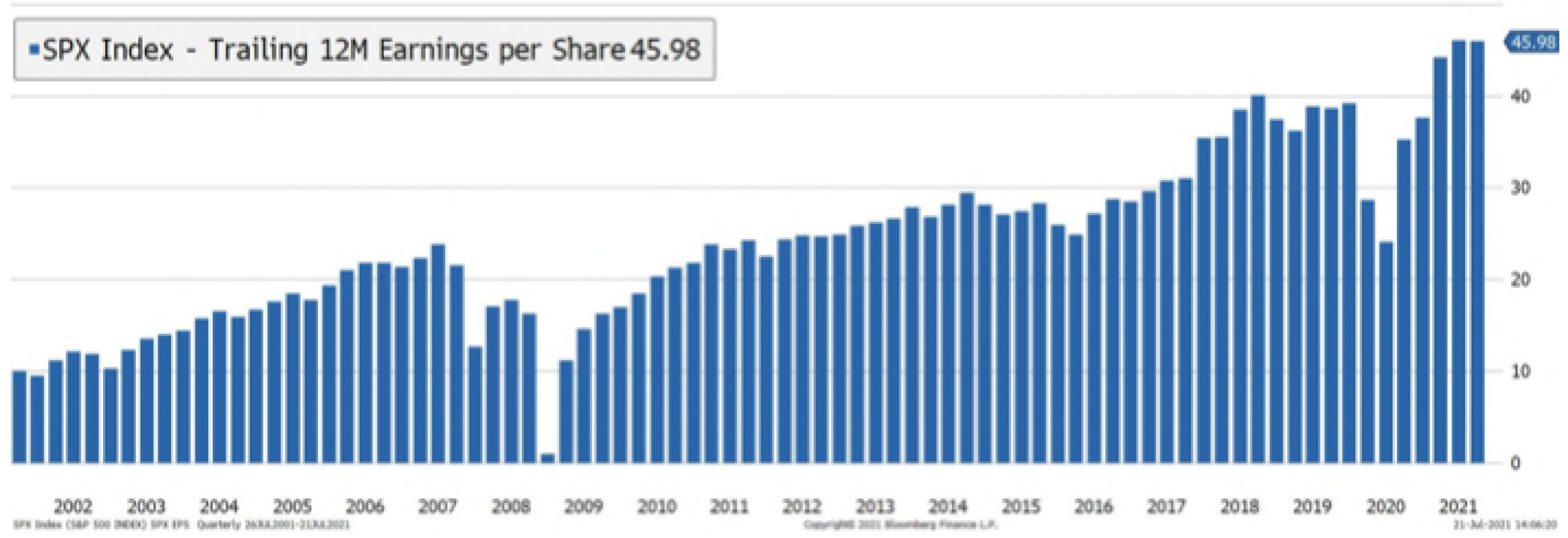

Despite the supply and demand shocks described above, U.S. stocks are set to report record earnings for the second quarter, as shown in the chart below. With stock prices also at record levels, this would suggest that any Covid related inflation has only benefited stocks so far. However, investors should also be aware of the potential negative impact that inflation can have on stock prices. Stock prices are simply the discounted value of all future expected cash flows. Persistent inflation would ultimately lead to higher interest rates. Therefore, an increase in current interest rates (the discount rate) would lead to a lower current price. Stocks with elevated Price to Earnings (PE) ratios would be most at risk for PE contraction in a rising rate environment.

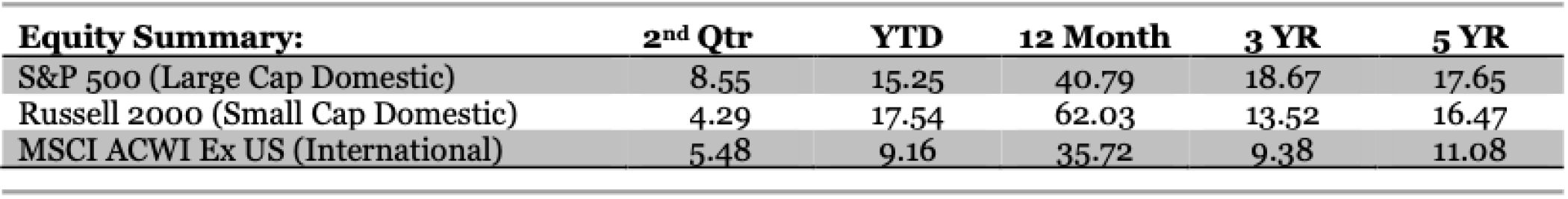

Throughout the pandemic, we have seen wide swings in market leadership. The most recent quarter has once again favored large U.S. based growth stocks with the S&P outpacing the smaller stock Russell 2000 Index in the second quarter. This comes after 9 months of smaller stock outperformance as shown in the 12 month return numbers above. Smaller stocks still trail on a longer-term basis and large U.S. growth stocks are still trading at elevated PE ratios. We see these valuations as being vulnerable to any rise in interest rates and continue to prefer other areas of the market. This includes value, small/mid cap, and international stocks.