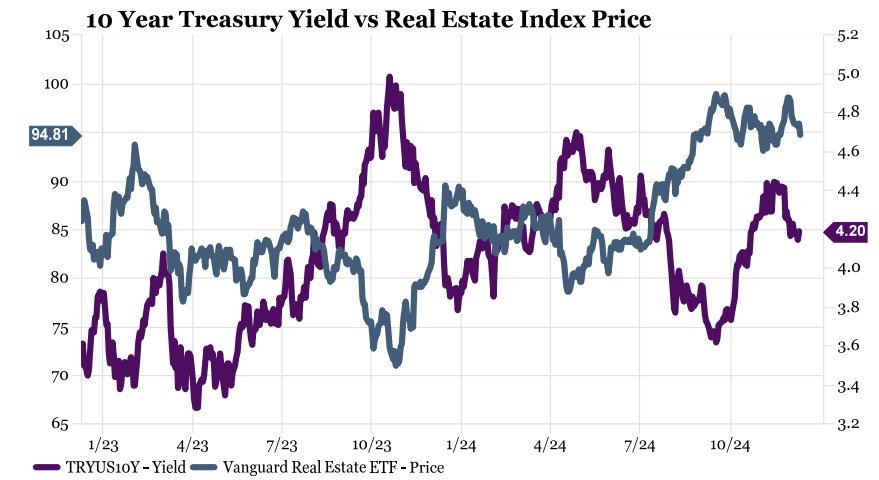

It is often said that the 3 L’s in real estate are Location, Location, Location. While this adage is often true when buying a personal residence, investment real estate follows slightly different rules. Over the last 2 years, we have noticed an inverse relationship between interest rates and investment real estate. As interest rates increased in 2023, the overall real estate market were essentially flat only returning 0.70%. This year as interest rates have declined, the overall real estate market is up approximately 12.60%. This inverse relationship can clearly be seen by the chart below.

While real estate has seen a resurgence in 2024, it isn’t the only alternative investment that has performed well. Gold has continued higher and as of this writing it has pushed past $2,700 an ounce bringing its YTD return above 27.50%. Bitcoin is trading close to $65,000 returning investors over 50% so far in 2024. On the flip side, oil has sold off over the last 6 months and is currently trading at $70 a barrel, with a measly YTD return of 2%.

We still feel the valuation of many areas of the equity market remain stretched and in the alternative space are recommending an allocation to investments that could provide protection in the event of some market volatility. As always, we are available to help you meet your financial goals – reach out to any of our LCNB | Wealth officers for a more detailed discussion.

While real estate has seen a resurgence in 2024, it isn’t the only alternative investment that has performed well. Gold has continued higher and as of this writing it has pushed past $2,700 an ounce bringing its YTD return above 27.50%. Bitcoin is trading close to $65,000 returning investors over 50% so far in 2024. On the flip side, oil has sold off over the last 6 months and is currently trading at $70 a barrel, with a measly YTD return of 2%.

We still feel the valuation of many areas of the equity market remain stretched and in the alternative space are recommending an allocation to investments that could provide protection in the event of some market volatility. As always, we are available to help you meet your financial goals – reach out to any of our LCNB | Wealth officers for a more detailed discussion.